The prevalence of dishonesty among job applicants is a growing concern for recruiters and hiring managers. A staggering 70% of workers confess to having lied on their resumes, with 37% admitting to doing so frequently. The lies range from embellishing job titles and responsibilities (52%) to fabricating entire job positions (24%). This trend is not limited to resumes; 76% of workers have lied in their cover letters, and 80% have lied during job interviews.

The implications of these dishonest practices are far-reaching. Hiring based on fraudulent information can lead to poor job performance, cultural misfits, and legal repercussions. In addition, it damages the reputation of both the individual and the organisation involved.

Further exacerbating this issue, a 2020 study by Checkster surveyed 400 job seekers and 400 hiring managers, revealing that 78% of job seekers either misrepresented themselves or considered doing so on job applications and resumes. Among these, 45.7% admitted their lying was moderate and 3.3% extreme, while 28.5% said they lied “a lot” but not to an extreme extent.

Common resume lies included proficiency in in-demand career skills not actually possessed (60%), falsely increased employment duration to exclude a company (50.25%), inflating GPA for recent graduates (49%), and using titles like “director” instead of “manager” (41%). Other fabrications involved listing degrees from prestigious universities without having completed them, including false achievements, and misrepresenting reasons for leaving a job.

Interestingly, not all hiring managers are opposed to candidates who misrepresent themselves. About 29.4% would still hire such candidates with a good explanation, and 3.3% would hire regardless of the misrepresentation. Only 34.4% cited lying as an automatic disqualification.

On the other hand, the Blind study in 2019 found that 90% of respondents claimed they never lied to get a job. This study looked at academic degrees, technical abilities, criminal records, and other lies during job interviews. Large companies like SAP, Amazon, and Cisco had employees who admitted to lying, but most respondents from companies like Salesforce, Tableau, and Intuit claimed they never lied on their resumes.

Lying on a resume can have severe consequences, including damage to reputation, legal jeopardy, and career difficulties. Yet, some companies might still hire candidates who have lied, depending on the situation.

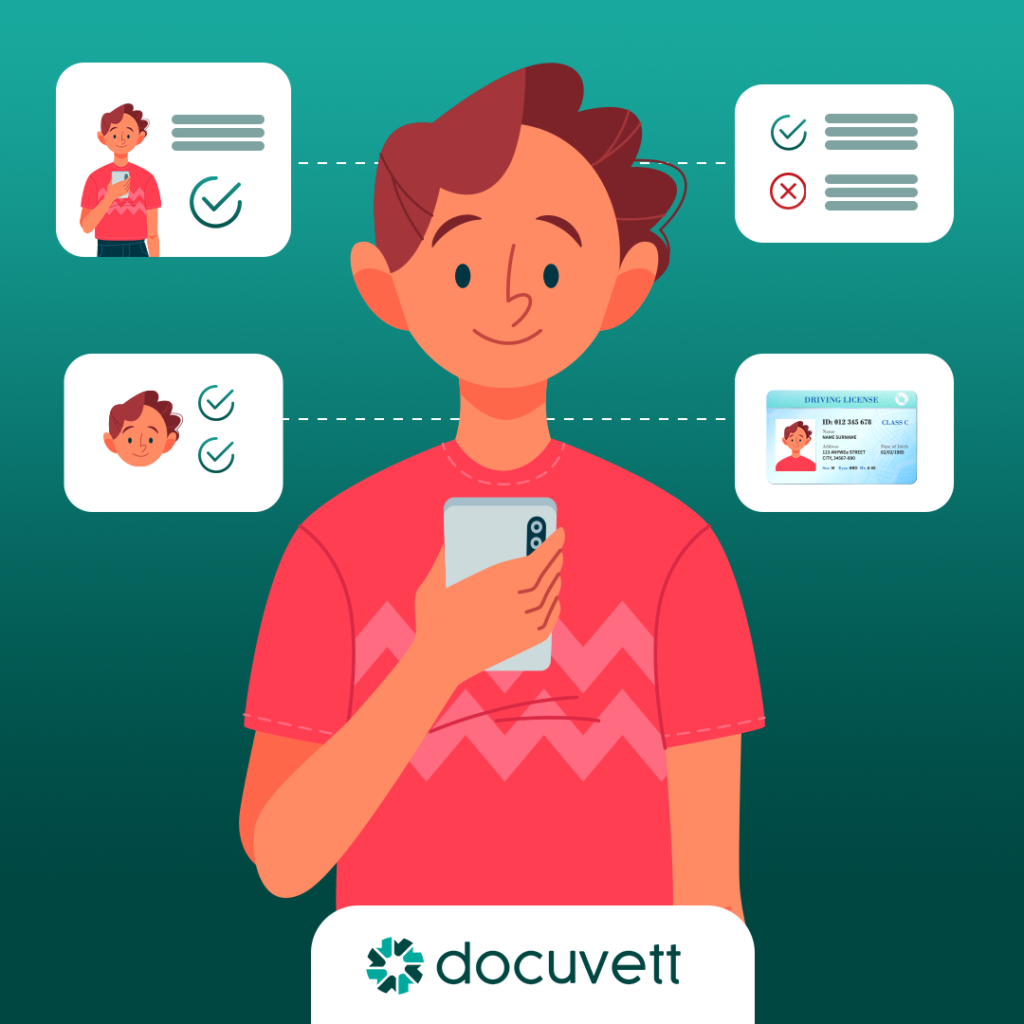

For recruiters and hiring managers, these findings underscore the importance of thorough vetting processes. Docuvett offers a solution to build “document trust” by allowing references to verify data and prove their identity, helping to ensure that candidates’ claims are legitimate. This tool can be invaluable in an environment where resume dishonesty is unfortunately common, providing a reliable way to verify applicant information and protect the integrity of the hiring process.

The use of Docuvett’s system can significantly reduce the likelihood of hiring based on fraudulent information and ensure that the candidates you bring into your organisation are genuinely qualified and honest. In today’s job market, where dishonesty on resumes is increasingly prevalent, having a reliable tool like Docuvett to verify candidate information is more important than ever. By implementing such a system, you can protect your organisation from the risks associated with resume fraud and make more informed hiring decisions, thereby maintaining the integrity and trustworthiness of your hiring process.